How to Finance Your US Master’s Degree

A master’s degree, be it an MS or an MBA, puts your career on a pedestal. The WorldGrad conducted a survey with over 13,000 recipients and learned that the US is the most popular study-abroad destination for postgraduate aspirants. Financing an American master’s degree can be intimidating. In this blog, we will break down all key aspects of funding your postgraduate education in the US and share some insights on US study loan requirements and US scholarships for Indian students that will help you save a significant amount of money.

Understanding the Costs

Before diving into financing options, it’s essential to have a clear picture of the financial landscape you’ll encounter when pursuing a postgraduate degree in the US:

Tuition and Fees: Tuition costs can vary widely depending on the institution, program, and location. Public universities often offer more affordable options than private ones.

Living Expenses: Beyond tuition, you’ll need to consider housing, groceries, transportation, and personal expenses. These can vary greatly depending on where you choose to study.

Books and Materials: Graduate-level courses may require specific textbooks, software, or research materials.

Health Insurance: Many universities require students to have health insurance, and you’ll need to budget for this expense.

Research and Projects: Depending on your field of study, there may be additional costs related to research projects or fieldwork.

Types of Funding Options

Scholarships: Scholarships provide students with financial support based on their academic achievements, talents, or specific criteria. Scholarships for MBA or MS in the USA for Indian students can significantly reduce the cost of studying abroad and are often awarded by universities, governments, or private organisations.

Grants: Grants are non-repayable funds awarded to students based on financial need or specific qualifications. They can come from various sources, including government agencies and nonprofit organisations, and help cover tuition, living expenses, or research projects while studying abroad.

Assistantships: Assistantships offer students the opportunity to work part-time on campus or assist professors with research and teaching in exchange for financial aid. These positions can help reduce the overall cost of education while providing valuable work experience.

Education Loans: A significant number of students take education loans for an MBA in the USA. Education loans are borrowed funds that help students finance their studies abroad. They come from financial institutions and may have varying interest rates and repayment terms, allowing students to invest in their education with the flexibility of repayment after graduation. These education loans in the USA for Indian students are a good option, but they should be considered carefully. They need to be repaid with interest, and accumulating significant debt can impact your financial future.

Financial Aid from India: Indian organisations like Tata and Rotary Groups offer financial aid to students pursuing international education. These organisations often provide scholarships, grants, or fellowships specifically designed to support Indian students in their academic pursuits abroad.

On-Campus Employment: On-campus employment opportunities allow students to work part-time jobs at their host institution. This source of income can help cover living expenses and gain practical experience while maintaining a manageable work-study balance during their study-abroad experience.

Now, you know the basics of funding your MS or MBA in the USA. However, if you want to be smarter than the rest, you must be armed with information that the others do not have yet. Let us discuss how you can finance your US master’s degree like a SmartGrad.

Smart Financing for SmartGrads

The cost of education is one of the key decision-making factors for study-abroad aspirants. The WorldGrad understands this and goes the extra mile to make a US master’s degree more affordable and accessible.

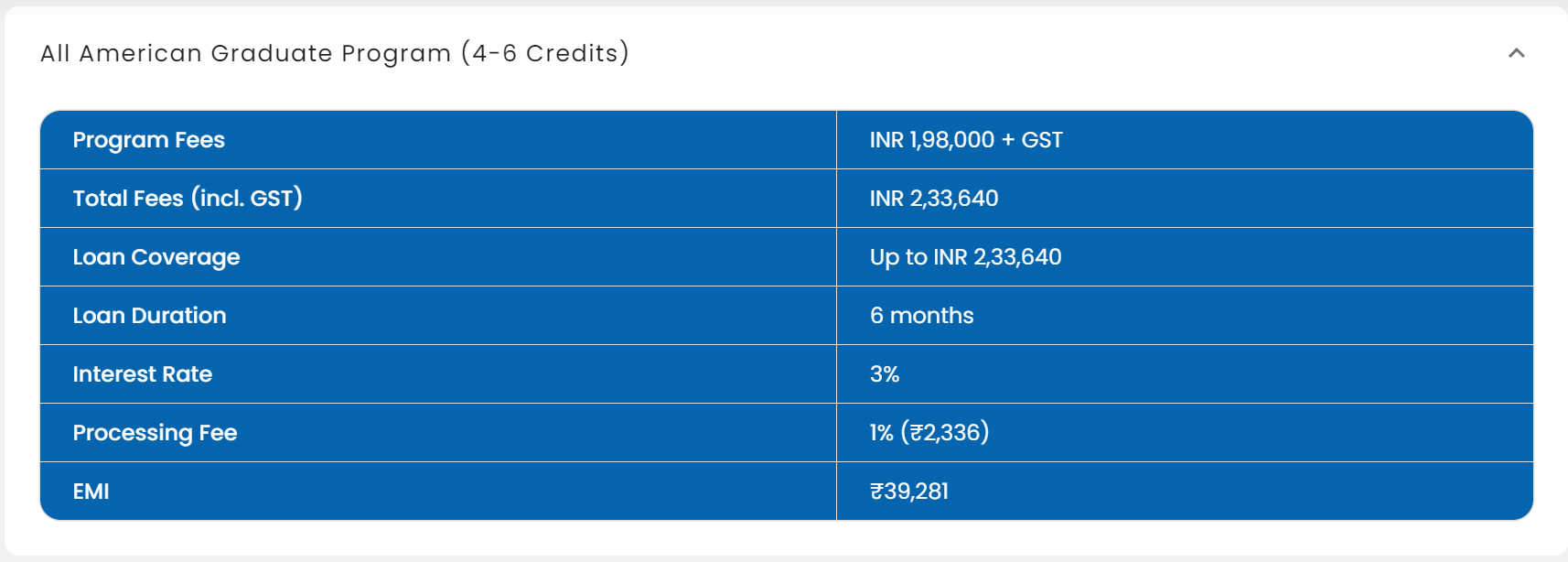

The All American Graduate Smart Program allows you to complete one semester of your US MBA or MS with The WorldGrad and upon completion, guarantee admission to any of our popular university partners for the remainder of your degree.

With our Smart Program, you avail of subsidised tuition, no living expenses for the first semester, and low-interest education loans. Moreover, you can work for 4 more months while you study and offset the cost of your Smart Program. Further, The WorldGrad saves up to 25% on education costs and makes your US master’s degree affordable and accessible.

The WorldGrad has partnered with GyanDhan, India’s largest education financing marketplace, to offer excellent education loans. To finance your Smart Program, here’s how you benefit.

You can start your US MS or MBA for as low as INR 39k a month with our Smart Program. With just a 3% interest rate to cover your Smart Program costs, it becomes cost-effective and accessible.

By the time you complete the first term with our Smart Program, you can improve your credit score and get easy access to education loans from our partners to finance the rest of your degree.

The WorldGrad makes a US postgraduate degree smarter and lighter on your pocket. Want to know more about the Smart Program? Talk to our counsellors.