How to Finance Your US Undergraduate Degree

Studying in the United States is a dream for many, but the financial aspects can often be challenging. From navigating through the intricacies of overseas education loans to managing living expenses, the journey is indeed multifaceted. In this guide, we’ll break down the essential components and unveil the smartest ways to fund your American bachelor’s degree.

Understanding the Costs

Before diving into financing options, it’s essential to grasp the various costs associated with pursuing a US undergraduate degree:

Tuition and Fees: Tuition fees vary significantly between universities and degree programs. On average, public institutions tend to have lower tuition rates than private universities, but this isn’t a hard-and-fast rule.

Room and Board: This includes the cost of accommodation and meals. Living on campus may be more expensive than off-campus housing.

Books and Supplies: Course materials, textbooks, and supplies can add up over the course of your studies.

Health Insurance: Many universities require students to have health insurance, and they often offer plans that you can purchase.

Personal Expenses: This covers transportation, clothing, entertainment, and other miscellaneous costs.

Exploring Funding Options

Scholarships: Scholarships are one of the most sought-after forms of financial aid. They can be merit-based, need-based, or awarded for specific achievements or talents. Numerous US universities and external programs offer scholarships for Indian students to study in USA.

Grants: Grants are typically need-based and don’t need to be repaid. The US government, as well as various organisations and foundations, offer grants to eligible students.

Work-Study Programs: These programs allow you to work on or off campus to earn money while studying. Work-study positions are often related to your field of study.

Assistantships: Graduate students often benefit from teaching or research assistantships. However, some undergraduate programs also offer assistantship opportunities.

Loans: Education loans in the USA for Indian students are another option, but they should be considered carefully. They need to be repaid with interest, and accumulating significant debt can impact your financial future. Federal loans may be more favourable than private loans.

Financial Aid from India: Some organisations offer financial aid or scholarships to students pursuing higher education abroad. For instance, the Tata Group or the regional Rotary Clubs often help fund overseas education.

On-Campus Employment: Many universities offer on-campus job opportunities for international students. These can help cover living expenses and provide valuable work experience.

So far, what we discussed is the fundamentals of financing your American bachelor’s degree. However, this is something that almost all students learn in this pursuit. Let us now explore how you can fund your US undergraduate degree like a SmartGrad.

Smart Financing for SmartGrads

The WorldGrad understands the challenges that students and families face when studying abroad. In addition to guaranteeing admissions to leading universities in Australia, the UK, and the US, we also help you save significant money.

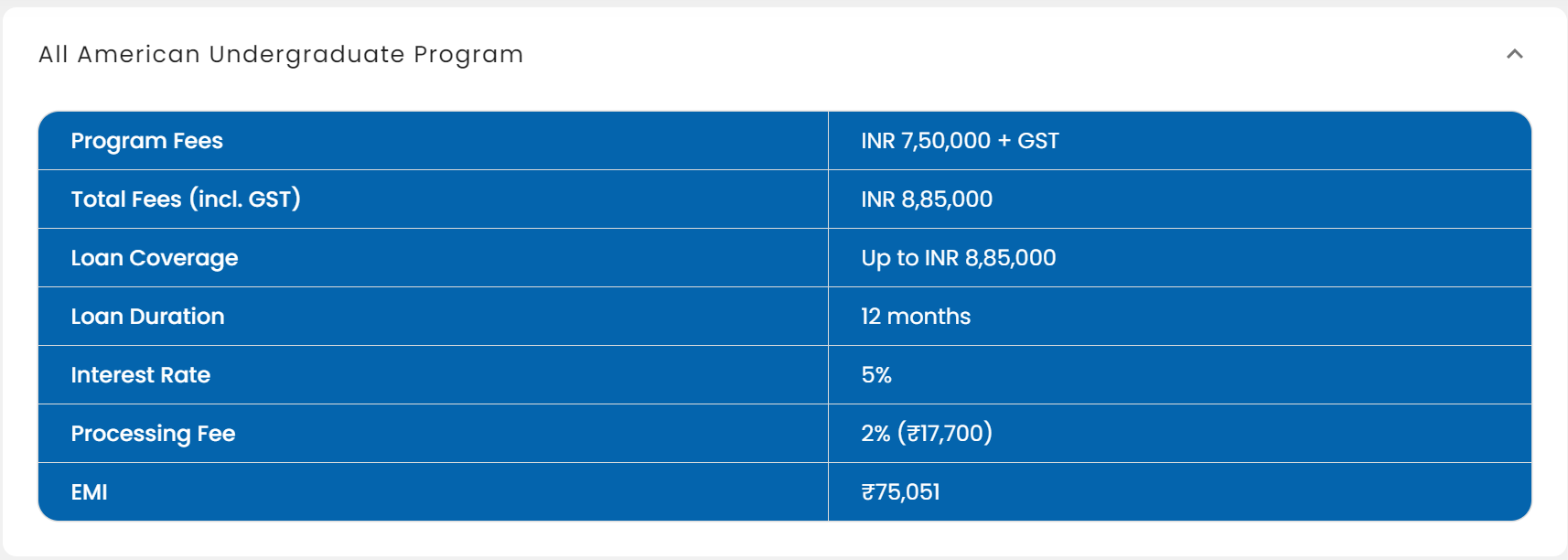

The All American Undergraduate Smart Program allows you to complete one year of your bachelor’s degree with The WorldGrad and upon completion, guarantee admission to any of our popular university partners for the remainder of your degree.

With our Smart Programs, you get subsidised tuition fees, no living expenses for up to one year, exclusive scholarships, and easy access to low-interest loans. The WorldGrad has partnered with GyanDhan, India’s largest education financing marketplace, to make education loans accessible to you.

To finance your Smart Program, GyanDhan offers excellent student loans. Here are the highlights.

You can start your degree for as low as INR 75k a month. We make the degree highly accessible and cost-effective with just a 5% interest rate. With The WorldGrad, you save over INR 30L on your US bachelor’s degree.

Upon completing the Smart Program, you get easy access to overseas education loans with our partners. With these benefits, you can pursue your American Dream without breaking the bank!

Want to know more about the Smart Program and how you can benefit from it? Speak to our counsellor now.